Our audit committee will approve only those transactions that it determines are fair to us and in our best interests.

| | | | | | | | |

| Coursera | 33 | 2024 Proxy Statement |

Executive Compensation

Compensation Discussion and Analysis

This Compensation Discussion and Analysis is intended to assist our stockholders in understanding our executive compensation program by providing an overview of our executive compensation-related policies, practices, and decisions for the year ended December 31, 2023. It also explains how we determined the material elements of compensation for our principal executive officer, our principal financial officer, and the three executive officers (other than our principal executive officer and principal financial officer) who were our most highly-compensated executive officers for the year ended December 31, 2023, and who we refer to as our “named executive officers” or “NEOs.”

2023 Named Executive Officers

For 2023, our NEOs were:

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | |

| Jeffrey N. Maggioncalda President, Chief Executive Officer, and Director (Our CEO) | Kenneth R. Hahn Senior Vice President, Chief Financial Officer, and Treasurer (Our CFO) | Leah F. Belsky Senior Vice President and Chief Revenue Officer | Alan Cardenas Senior Vice President, General Counsel, and Secretary | Shravan K. Goli Senior Vice President and Chief Operating Officer |

|

Specifically, this Compensation Discussion and Analysis provides an overview of our executive compensation philosophy, the overall objectives of our executive compensation program, and each compensation element that we provide to our executive officers. In addition, it explains how and why the LDEIC committee arrived at the specific compensation decisions for our executive officers, which include our NEOs, in 2023. This Compensation Discussion and Analysis is intended to be read in conjunction with the “Executive Compensation Tables” section of this proxy statement below, which provides further historical compensation information.

Executive Summary

Our executive compensation program is designed to attract, retain, and motivate the key leaders who drive our strategic and financial performance. Our program structure and compensation decisions serve to meet these talent management objectives and align the compensation of our executive officers with our performance and long-term value creation for our stockholders.

2023 Business Highlights

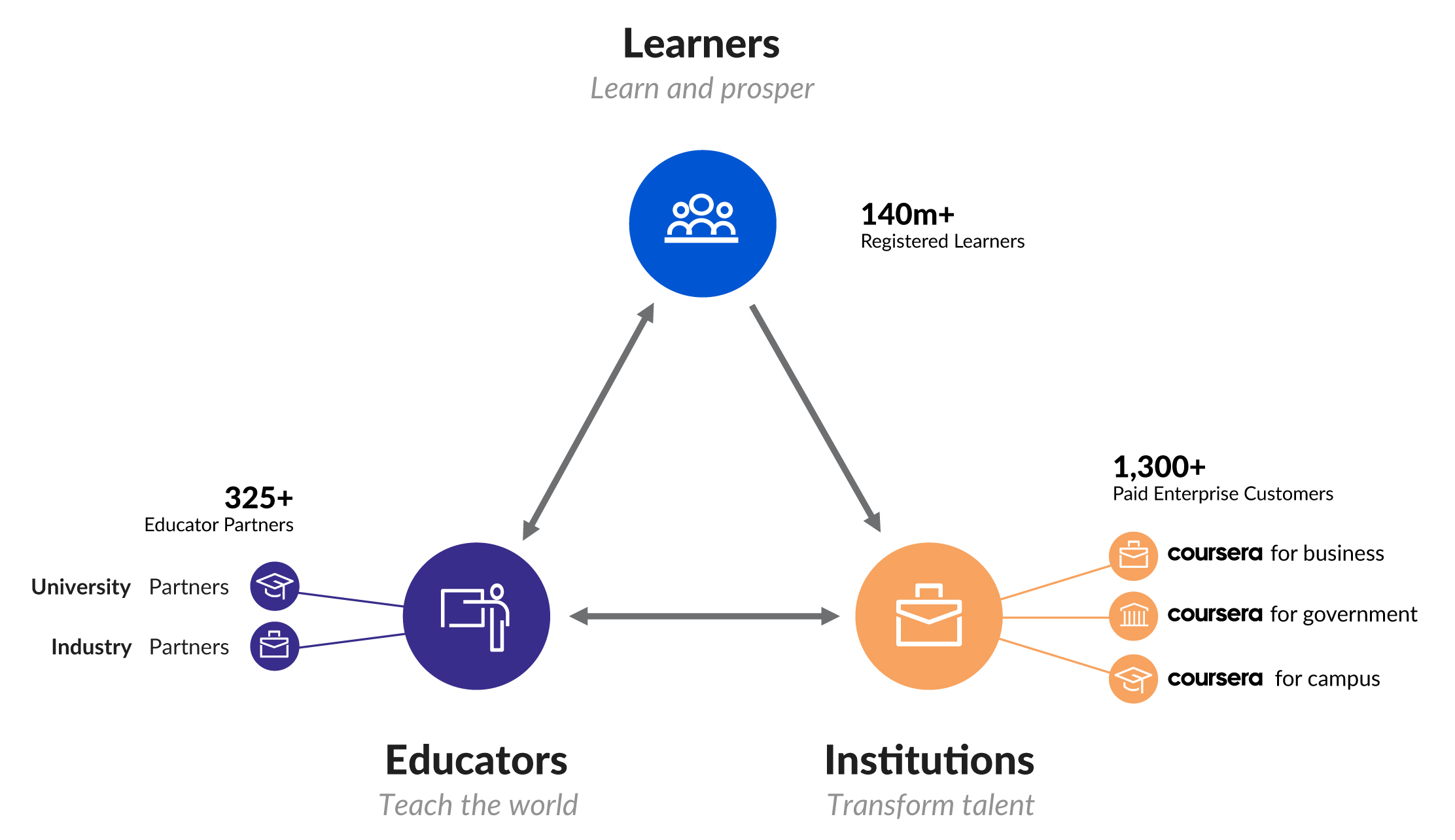

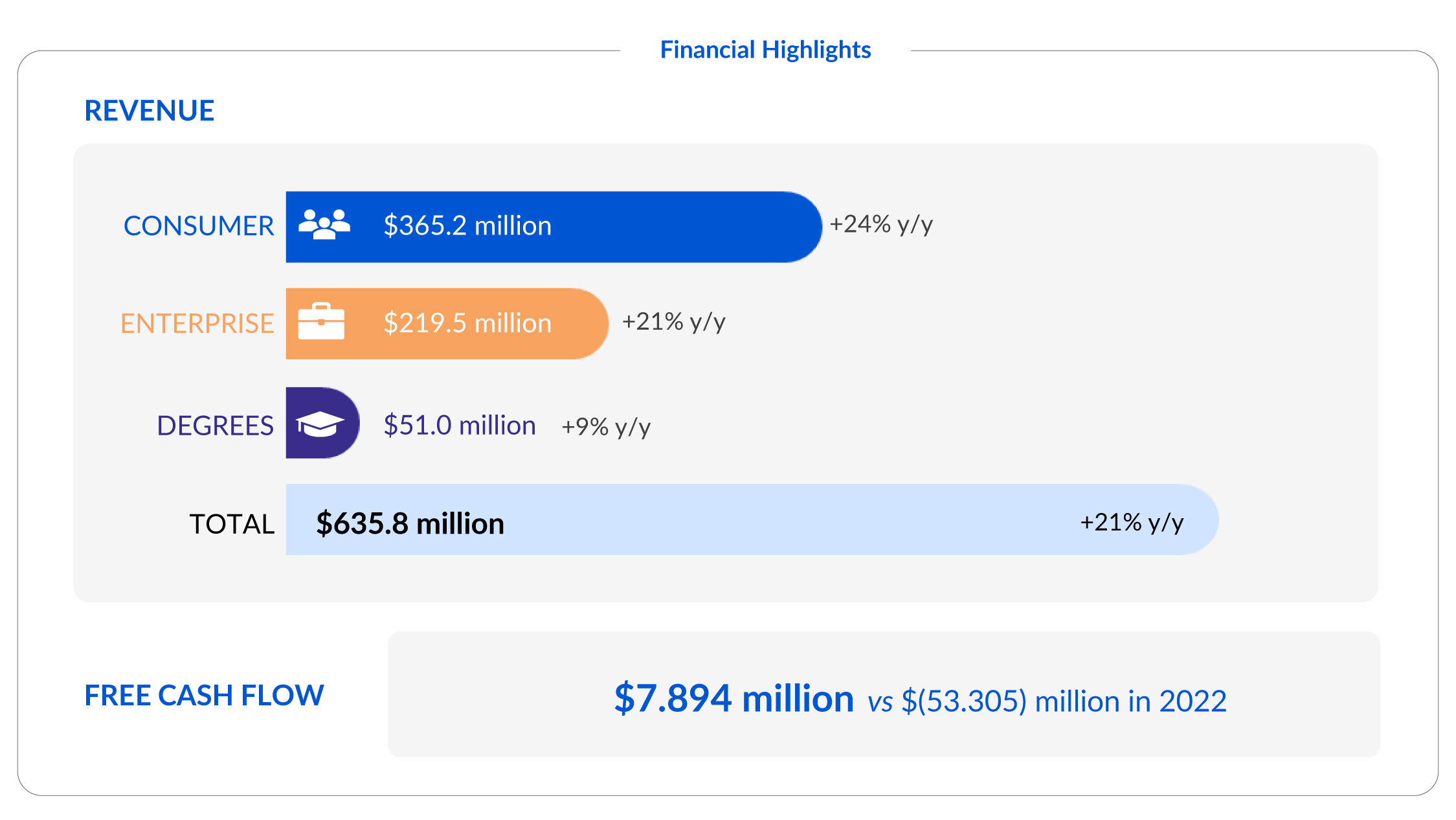

In 2023, we delivered strong results, executing amidst a challenging external environment that remained dynamic. During 2023, we delivered the following financial and strategic results:

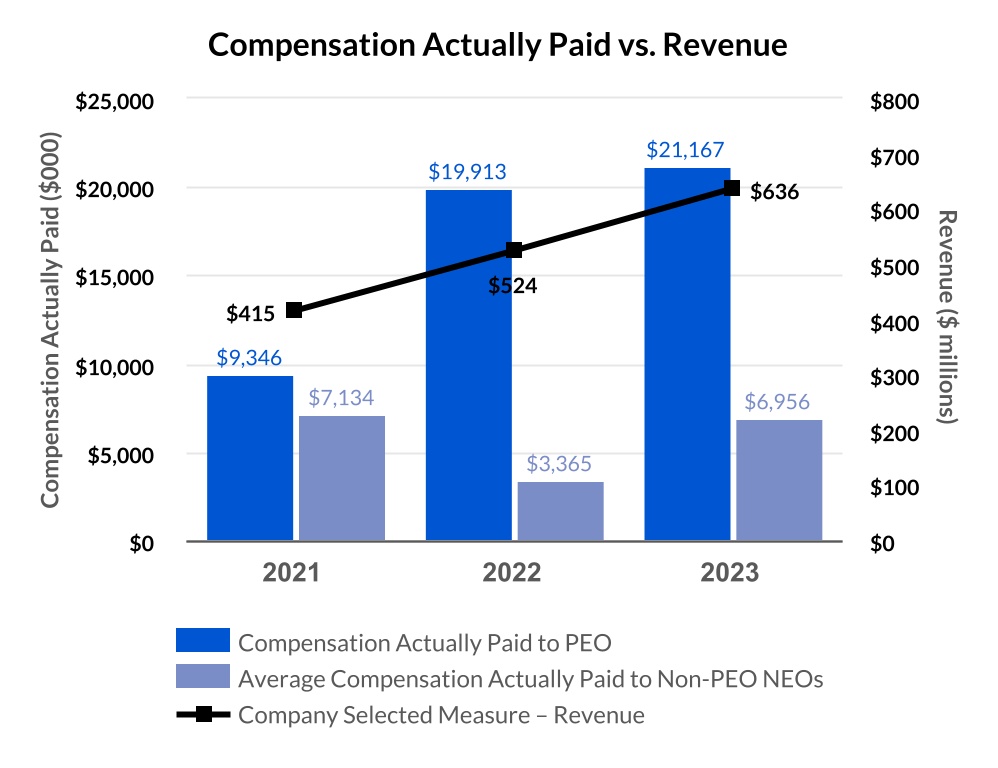

•Delivered year-over-year revenue growth of 21%, reflecting the demand we continue to see from individuals and institutions seeking the latest digital skills and branded credentials for today’s fast-changing economy and technology landscape.

•Achieved our growth with increased leverage, including our first positive Adjusted EBITDA quarter, delivering on our commitment to build a platform and business model that scales.

| | | | | | | | |

| Coursera | 34 | 2024 Proxy Statement |

•Added approximately 24 million new registered learners, growing our global learner base to approximately 142 million.

•Broadened our Enterprise customer base with more than 200 new Paid Enterprise Customers, including businesses, governments, and campuses.

•Announced approximately 20 new entry-level Professional Certificates from partners, including Amazon Web Services (AWS), Google, IBM, and Microsoft.

•Announced nearly 20 new degree programs from U.S. and international universities, emphasizing growing pathways between our open content and college degrees to drive accessibility, affordability, and job-relevance.

•Expanded the number of courses and credentials with American Council on Education credit recommendations, while securing our first regional recommendations with the European Credit Transfer and Accumulation System.

•Accelerated our AI-powered translation initiative, allowing learners speaking up to 18 popular languages like Arabic, French, German, Spanish, Thai and more to access over 4,000 courses, Specializations, and Professional Certificates in their local language.

•Introduced Coach, our virtual learning assistant powered by generative AI and grounded in our expert content, with encouraging initial feedback and engagement from learners in our beta program.

Please refer to our Annual Report for additional 2023 financial and business information.

2023 Executive Compensation Highlights

Our strong belief that executives’ interests should be aligned with our stockholders’ experience underpins our executive compensation program. Consistent with this goal, our compensation program is designed so that a substantial portion of our executive officers’ target annual compensation opportunity is both variable in nature and “at-risk”. In addition, the LDEIC committee sets challenging performance goals for each of the metrics used under our incentive compensation programs so that what executives

| | | | | | | | |

| Coursera | 35 | 2024 Proxy Statement |

ultimately earn is based on strong performance measured against pre-established objectives that are key to our success and, ultimately, stockholder value creation.

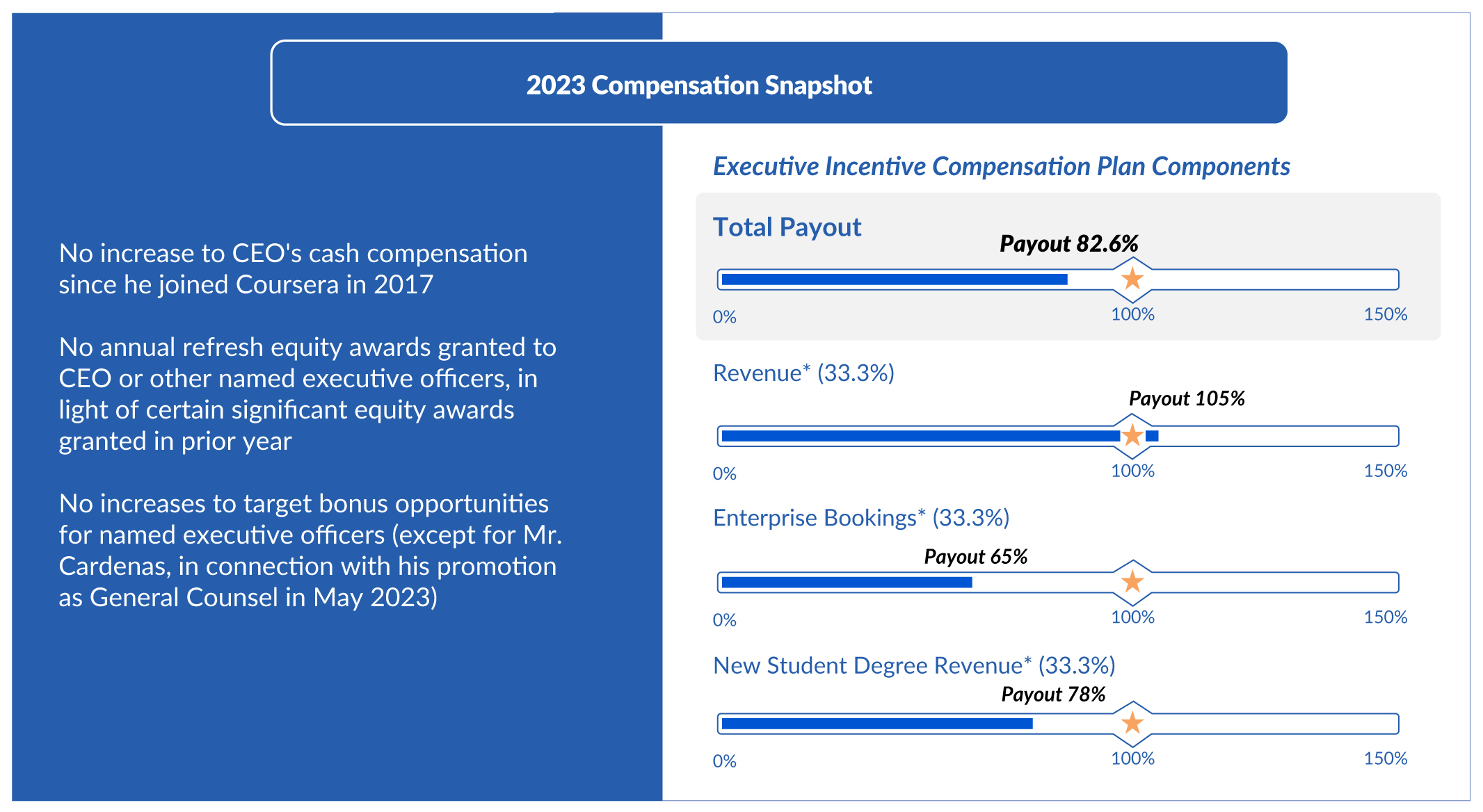

Consistent with our performance and compensation philosophy, the LDEIC committee took the following compensation actions for our NEOs in 2023:

•Base Salaries: None of our NEOs received a base salary increase in 2023 except for Mr. Hahn who received a salary increase of 5% in March 2023 as a merit increase and Mr. Cardenas, who received a salary increase of 3% in March 2023 as a merit increase and an increase of 14% in connection with his promotion to General Counsel. At his request, the base salary of our CEO, Mr. Maggioncalda, has not been increased since he joined us in 2017.

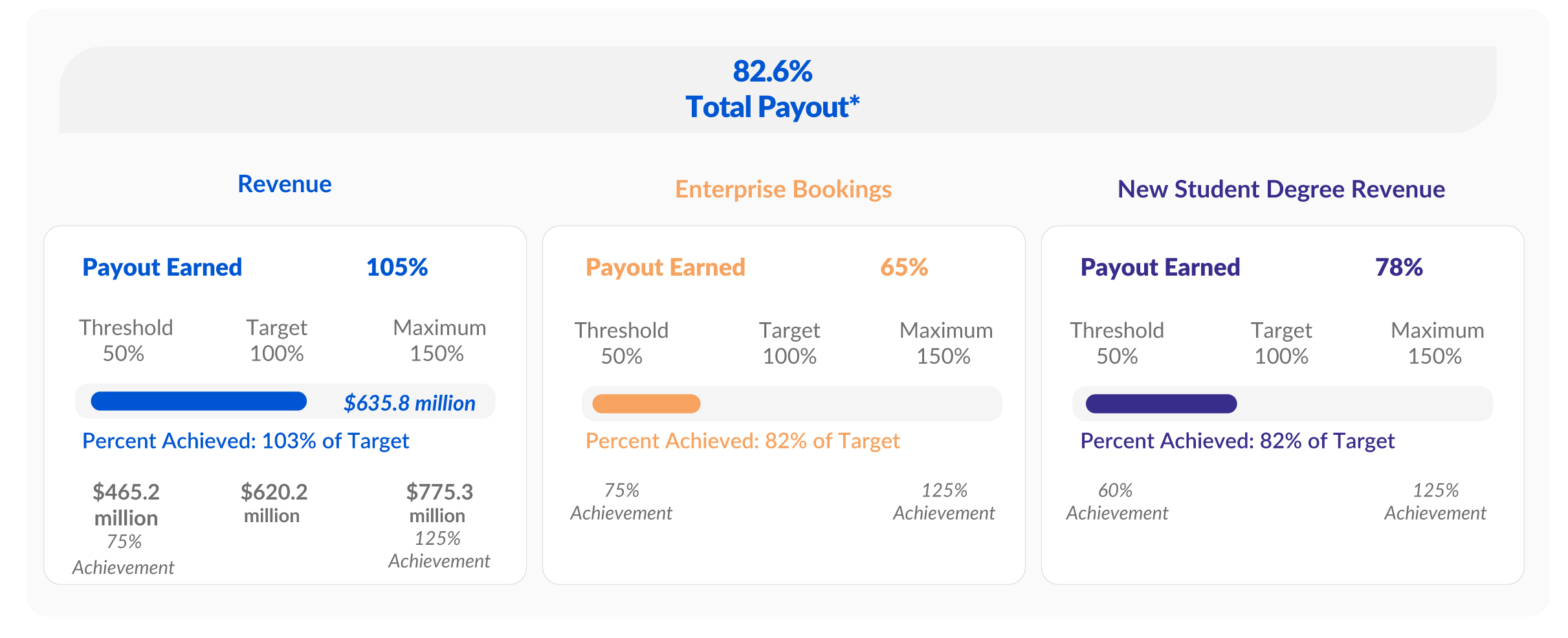

•Annual Cash Incentive Bonus Opportunities: All of our NEOs maintained the same annual cash incentive bonus target percentages for 2023 as in 2022 except for Mr. Cardenas whose target percentage increased from 30% to 50% of his base salary effective in May 2023 in connection with his promotion to General Counsel, with his 2023 bonus payout prorated accordingly. At his request, our CEO has declined increases to his annual cash incentive bonus target since he joined us in 2017, despite his bonus target opportunity being below public company norms for a CEO. Based on the achievement of pre-established metrics, the 2023 cash incentive bonuses for our NEOs were earned and paid at 82.6% of target.

•Equity Awards (Long-Term Incentives): We did not grant any equity awards to our NEOs in 2023 except for Mr. Cardenas who received RSU and stock option awards that vest quarterly over four years subject to his continued employment, in connection with his promotion to General Counsel. We resumed equity grants for our NEOs in the first quarter of 2024 (other than our CEO who declined to receive an equity award in 2024) and expect to resume granting annual refresh equity awards to our NEOs, including our CEO, in the first quarter of 2025.

•Stockholder Outreach and Response to Feedback - Introduction of Stock Ownership Guidelines and Performance Based Equity Awards: We engaged in significant stockholder outreach in connection with the results of our say-on-pay vote in 2023 in order to better understand the concerns of our largest stockholders. As a result of stockholder feedback, in 2024, we adopted stock ownership guidelines and introduced performance-based restricted stock units (“PSUs”) to our executive compensation program. For 2024, PSUs represent 25% of equity awards granted to our executive officers (other than our CEO who declined to receive an equity award in 2024). For 2024, the PSUs are based on a revenue goal over a one-year performance period, with a four-year total vesting schedule. We will continue to review the mix of PSUs and RSUs in future years with the goal of increasing the weighting of PSUs to align with market norms. We will also periodically review the performance metric(s) and the length of the performance period. For more information on our stockholder engagement, 2024 PSU program, see the “Stockholder Engagement and our Say-on-Pay Vote” and “2024 PSU program” sections of this Compensation Discussion & Analysis.

•Clawback Policy Adoption: We adopted an incentive compensation recoupment policy (“clawback policy”) that complies with SEC rules and NYSE listing standards. The policy requires recoupment of erroneously awarded incentive-based compensation paid to our current or former executive officers in the event of an accounting restatement.

•No Perquisites: Consistent with our past practice, we did not provide any perquisites to our NEOs in 2023.

| | | | | | | | |

| Coursera | 36 | 2024 Proxy Statement |

* The performance measures under our 2023 Executive Incentive Compensation Plan are defined and further described in “Compensation Elements—Annual Cash Incentive Bonus Opportunity”.

| | | | | | | | |

| Coursera | 37 | 2024 Proxy Statement |

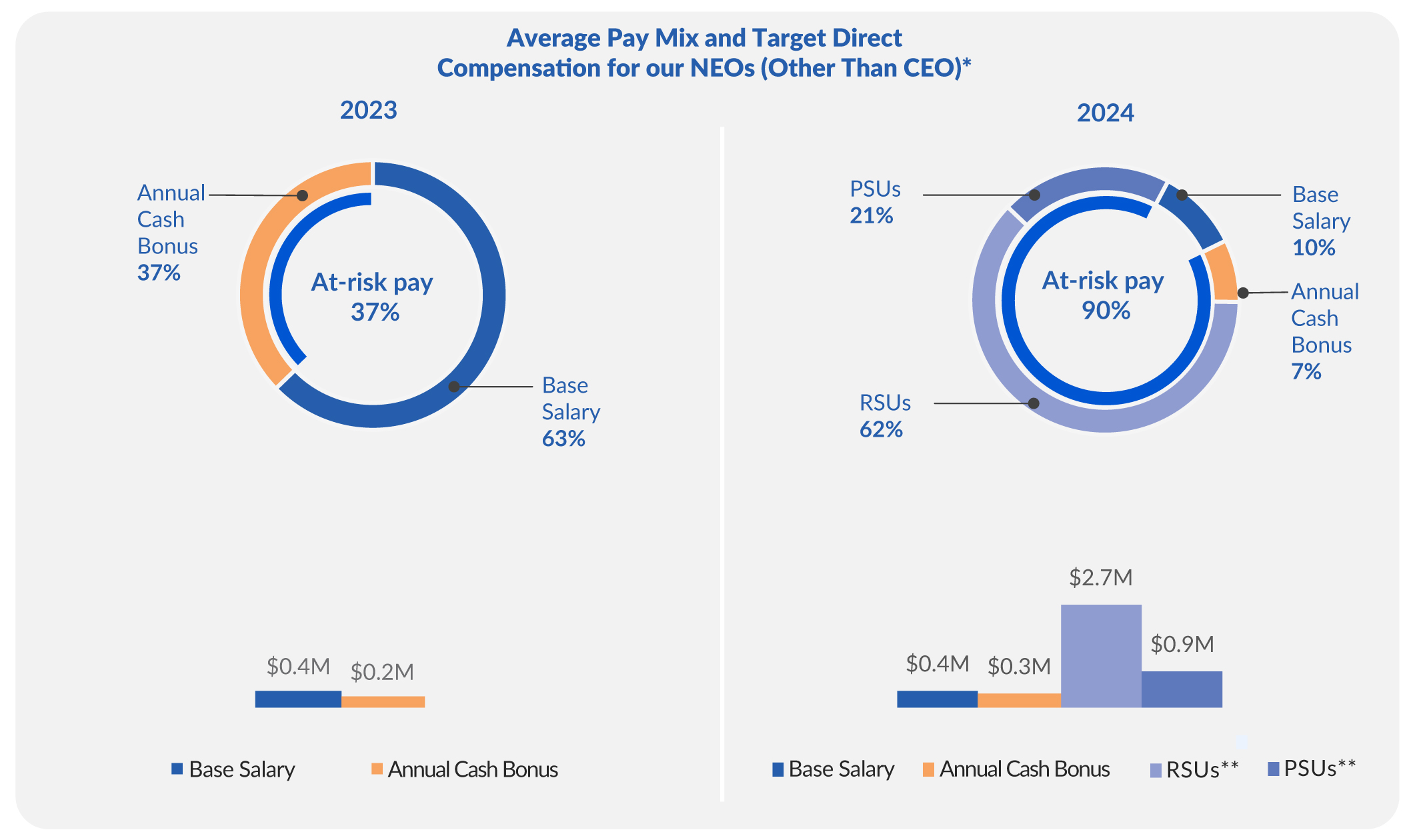

Emphasis on At Risk Compensation

Consistent with our compensation philosophy, our executive compensation program emphasizes “at-risk” pay over “fixed” pay and focuses on long-term incentives. The annual compensation of our executive officers varies from year to year based on our corporate financial and operational results and the performance of our stock price. In 2023, we did not grant equity awards to our NEOs, other than to Mr. Cardenas in connection with his promotion to General Counsel. As a result, total direct compensation in 2023 did not consist of a majority of at-risk pay.

For 2024, we expect that our introduction of PSUs as a component of our overall executive equity compensation program will result in a substantial portion of our NEOs’ compensation to be performance-based pay. The following chart shows the average pay mix for our NEOs (other than our CEO) in 2023 and their expected pay mix in 2024.

* The data excludes our CEO given that he declined to receive any equity awards in 2023 and 2024 in light of a significant “catch-up” equity award he was granted in 2022, as described in “Equity Awards (Long-Term Incentive Compensation)” below. The 2023 data excludes Alan Cardenas who was granted RSU and option awards in connection with his promotion to General Counsel in May 2023.

** Amounts are based on the average of the LDEIC committee’s targeted economic value of the RSU and PSU awards, respectively, granted in March 2024 to the applicable NEOs (other than our CEO). The average grant date fair values of such RSU and PSU awards is $2.3 million for the RSUs and $0.8 million for the PSUs, computed in accordance with ASC 718.

Pay-for-Performance

We believe our executive compensation program is reasonable, competitive, and appropriately balances the goals of attracting, motivating, rewarding, and retaining our executive officers with the goal of aligning their interests with those of our stockholders. To ensure alignment and to motivate and reward individual initiative and effort, a substantial portion of our executive officers’ target annual compensation opportunity is both variable in nature and “at-risk”.

| | | | | | | | |

| Coursera | 38 | 2024 Proxy Statement |

We emphasize at risk compensation that appropriately rewards our executive officers through two separate compensation elements:

•Bonuses: A substantial portion of our executive officers’ total compensation opportunity is derived from participation in our cash bonus plan, which provides annual cash payments based on short-term financial, operational, and strategic results that meet or exceed the objectives set by our LDEIC committee.

•Equity Awards: Equity compensation, in the form of RSUs and stock option awards, generally comprise a majority of our executive officers’ target total direct compensation opportunities. These awards are aimed at rewarding our executive officers over a multi-year period. The current and future economic value of these awards depends significantly on the value of our common stock, thereby incentivizing our executive officers to build sustainable long-term value for the benefit of our stockholders.

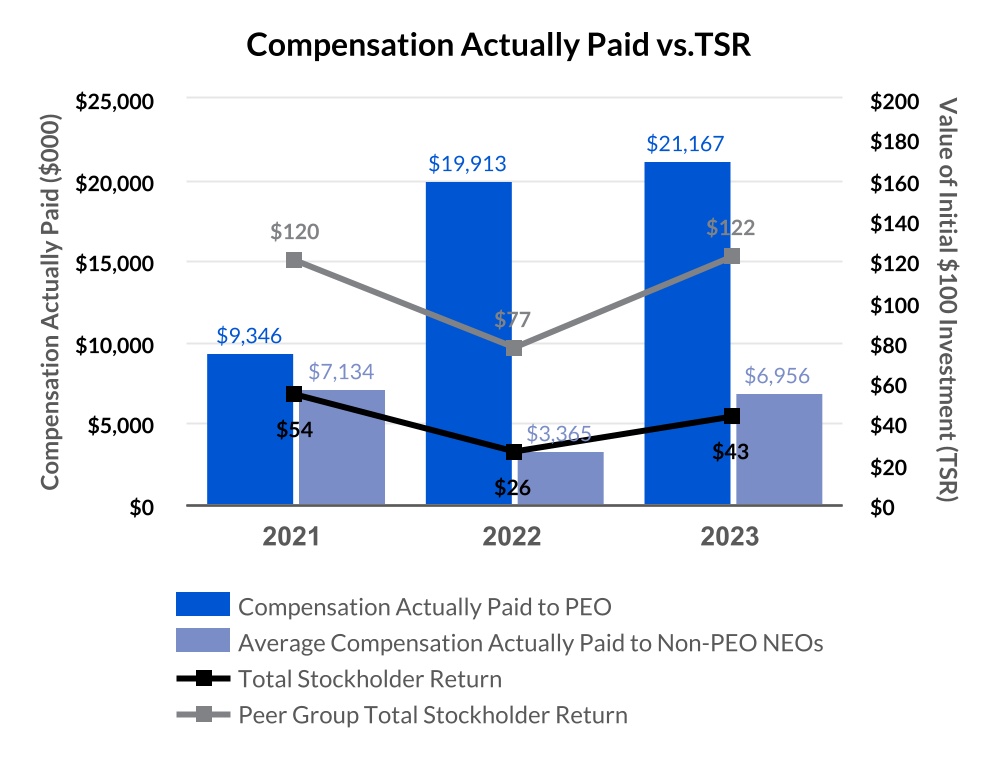

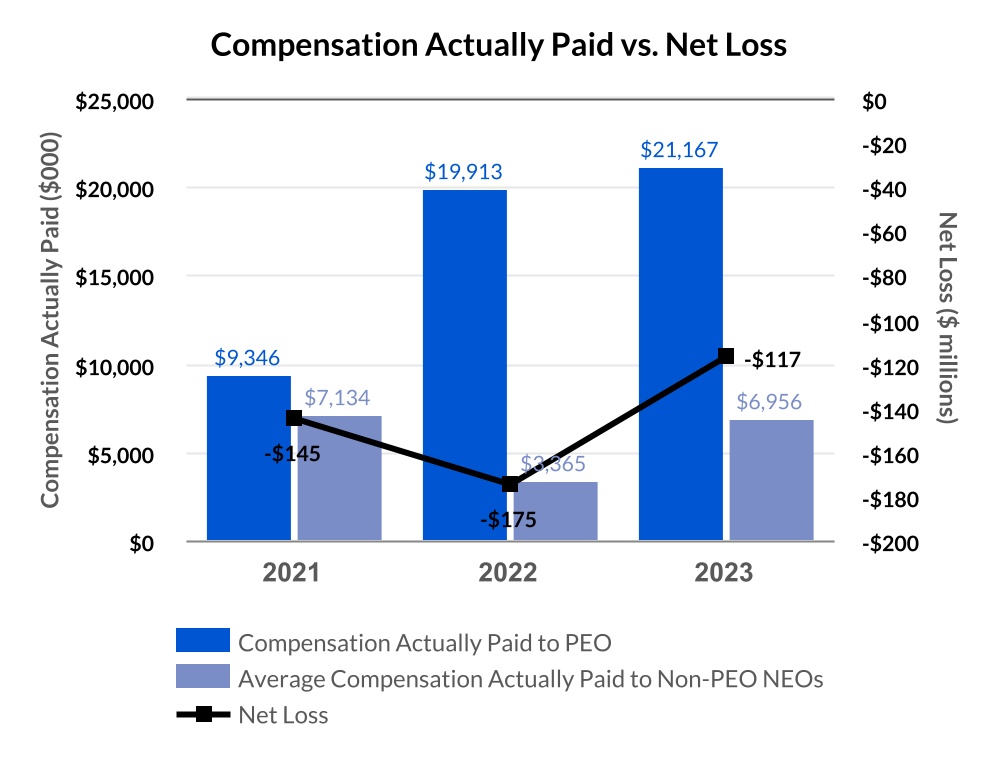

Variable pay elements ensure that, each year, a substantial portion of our executive officers’ target total direct compensation is contingent (rather than fixed) in nature, with the amounts ultimately payable subject to variability based on our performance. The performance goals we set for 2023 for our annual cash bonus plan were aggressive and resulted in a payment of approximately 82.6% of the target bonus level under the 2023 Executive Incentive Compensation Plan, as described in greater detail below. As we mature as a public company, we intend that our executive compensation program will continue to evolve to reflect our executive compensation philosophy and objective of rewarding strong performance with competitive and incentivizing compensation.

Executive Compensation Best Practices

We maintain sound executive compensation policies and practices, including compensation-related corporate governance standards, consistent with our executive compensation philosophy. During 2023, the following executive compensation policies and practices were in place:

üCompensation Committee Independence — Our compensation committee, the LDEIC committee, is composed solely of independent directors.

üLDEIC Committee Advisor Independence — The LDEIC committee utilizes an independent compensation consultant, which is retained directly by the LDEIC committee and provides no other services to Coursera.

üEmphasize Long-Term Equity Compensation — We use equity awards to deliver long-term incentive compensation opportunities to our executive officers. These equity awards vest over multi-year periods, which helps serve our long-term value creation goals and retention objectives.

üPay for Performance: Annual Bonuses — Consistent with our performance-based annual incentive program design, 100% of each executive officer’s cash bonus payment for 2023 was tied to Coursera’s performance metrics.

üAnnual Compensation Review — We conduct an annual review of our executive compensation philosophy and strategy, including a review of the compensation peer group used for comparative purposes.

üCompensation-Related Risk Assessment — We conduct an annual evaluation of our compensation programs, policies, and practices to ensure that they reflect an appropriate level of risk-taking but do not encourage our employees to take excessive or unnecessary risks that could have a material adverse impact on the company.

ü Reasonable Change-in-Control Arrangements — The post-employment compensation arrangements for our executive officers provide for amounts and multiples that are within reasonable market norms.

ü Annual Say-on-Pay Vote — We proactively seek annual stockholder feedback on our executive compensation program.

üSuccession Planning — We review the risks associated with our key executive positions on an annual basis so that we have an adequate succession strategy and plans are in place for our most critical positions.

üClawback Policy — We have a compensation recoupment, or clawback, policy that requires recoupment of erroneously awarded incentive-based compensation paid to our current and former executive officers in the event of an accounting restatement.

| | | | | | | | |

| Coursera | 39 | 2024 Proxy Statement |

ûNo Guaranteed Bonuses — Our annual cash incentive bonus plan for our executive officers is performance-based and does not provide for any guaranteed minimum payment levels.

ûNo Executive Retirement Programs — We do not offer a pension plan or other executive retirement or nonqualified deferred compensation plans or arrangements.

ûNo Executive Perquisites — We do not provide any special perquisites or other personal benefits to our executive officers.

ûNo Hedging and Pledging — Employees, including our executive officers, and non-employee directors are prohibited from hedging our securities and from pledging our securities as collateral for a loan, without the prior written approval of our General Counsel or such designee (in the absence of a General Counsel, our Chief Financial Officer).

ûNo Tax “Gross-Ups” or Payments — We do not provide any “gross-ups” or tax payments in connection with any compensation element.

ûNo Dividends — We do not have a practice of paying dividends and have not paid dividends or dividend equivalents on unvested equity awards.

Stockholder Engagement and our Say-on-Pay Vote

Our relationship with our stockholders plays an important part in our long-term success, and we are committed to maintaining an active dialogue to understand stockholders’ priorities and concerns.

At our 2023 annual meeting of stockholders, our Say-on-Pay vote on the compensation of our NEOs for 2022 received the support of 52% of the votes cast. The LDEIC committee and our full Board took this vote outcome seriously and undertook extensive stockholder outreach in order to better understand this vote result and solicit stockholder feedback. We contacted 16 of our largest stockholders, representing approximately 47% of our common stock held by non-affiliates and met with 9 investors representing approximately 34% of our shares outstanding as of the date of outreach. The majority of these engagements included members of our executive team.

We received valuable feedback on our executive compensation program, policies, and practices during these meetings and appreciate the time our investors spent with us. We plan to continue to conduct outreach annually to address any questions or concerns stockholders may have on our executive compensation program or broader governance practices.

After carefully considering these discussions, the LDEIC committee made two significant changes to our compensation program and practices beginning in 2024:

•Introduced PSUs into our long-term equity incentive program beginning in 2024; and

•Adopted Stock Ownership Guidelines for Board members and certain executives, including our NEOs, requiring individual ownership of a specified value of our common stock by the later of March 2029 or within five years from becoming a covered director or executive.

| | | | | | | | |

| Coursera | 40 | 2024 Proxy Statement |

The table below summarizes the principal areas of feedback we received relating to executive compensation and our responses to that feedback.

| | | | | | | | | | | | | | |

Key Topics Discussed with Stockholders | | What we Heard from Stockholders | | Our Perspective/how we Responded |

| | | | |

| | | | |

| Equity compensation design | | All stockholders we spoke with were supportive of Coursera incorporating performance-based equity compensation, such as PSUs, as a component of our equity incentive program. | | We did not grant any equity awards to our NEOs in 2023 (other than for Mr. Cardenas in connection with his promotion). Beginning in 2024, we granted PSUs to our NEOs (other than our CEO) that are expected to account for 25% of their target value of equity incentive awards for 2024 (the “2024 PSU Program”). |

| | | | |

| Compensation alignment with long-term strategic objectives | | Several stockholders encouraged us to avoid overly complex designs for our performance-based equity compensation and to think about how to align performance metrics with our long-term strategic objectives and our financial framework. | | The LDEIC committee considered stockholder feedback when designing the 2024 PSU program to implement performance metrics based on revenue achievement in alignment with our long-term strategic objectives and our financial framework. The LDEIC committee believes at our current stage of growth, revenue is the most critical measure of our performance and indicator of our long-term success. |

| | | | |

| Insider equity ownership | | Stockholders raised the importance of long-term equity ownership by our executives to further alignment with stockholders. Stockholders indicated a preference for equity award vesting periods between three and five years to foster a long-term mindset among senior leaderships. | | We adopted robust stock ownership guidelines applicable to our executives, as discussed in greater detail above in the “Board of Directors and Corporate Governance” section of this Proxy Statement. Stockholders favorably viewed the four-year time-based vesting schedule applicable to our NEOs’ 2022 RSU grants. No RSUs were granted to our NEOs in 2023 (other than for Mr. Cardenas in connection with his promotion). For 2024, we maintained the four-year time-based vesting schedule for RSU awards granted to our NEOs, except for our CEO, who we do not expect will be granted equity awards in 2024. |

| | | | |

| CEO equity grant size | | The stockholders we spoke with who voted against the 2023 say-on-pay proposal remarked on the size of our CEO’s 2022 equity awards as a significant factor in their decision-making. | | We re-emphasized that our 2022 awards to our CEO were substantially larger than a typical annual grant due to the need to ensure appropriate retentive hold for our CEO as we transitioned our equity granting practices from our historic “box car” approach to an annual cadence more typical for public companies. As part of this transition, we expect to grant equity in the first quarter of each fiscal year. Accordingly, following our November 2022 grants, no NEOs received an equity award during 2023 (other than Mr. Cardenas in connection with his promotion), and our 2024 equity awards are expected to be granted to all NEOs other than our CEO. Our CEO did not receive any equity awards in 2023, and we have not and do not plan to grant our CEO an equity award in 2024. We intend to provide our CEO with market-aligned annual equity awards beginning in 2025. |

Compensation Philosophy and Guiding Principles

We have designed our executive compensation program to reward our executive officers at a level consistent with our overall strategic and financial performance and to provide remuneration sufficient to attract, retain, and motivate them to exert their best efforts in the highly-competitive technology and consumer-oriented environments in which we operate. We believe that competitive compensation packages consisting of a combination of base salaries, annual cash bonus opportunities, and long-term incentive opportunities in the form of equity awards that are earned over a multi-year period, enable us to attract top talent, motivate successful short-term and long-term performance, satisfy our retention objectives, and align the compensation of our executive officers with our performance and long-term value creation for our stockholders.

| | | | | | | | |

| Coursera | 41 | 2024 Proxy Statement |

As we mature as a public company, we expect that our executive compensation program will continue to evolve to reflect our executive compensation philosophy and objective of rewarding strong performance with competitive and incentivizing compensation. At a minimum, we expect the LDEIC committee to review executive compensation annually.

Compensation-Setting Process

Role of the LDEIC Committee

The LDEIC committee, among its other responsibilities, establishes our overall compensation philosophy and reviews and approves our executive compensation program, including the specific compensation of our executive officers and the compensation of the non-employee members of our Board. The LDEIC committee has the authority to retain special counsel and other advisors, including compensation consultants, to assist in carrying out its responsibilities to determine the compensation of our executive officers. The LDEIC committee’s authority, duties, and responsibilities are described in its charter, which is reviewed regularly and revised and updated as warranted. The charter is available on our Company website at https://investor.coursera.com/ under the heading “Governance — Governance Documents.”

While the LDEIC committee determines our overall compensation philosophy and approves the compensation of our executive officers, it relies on its compensation consultant and legal counsel, as well as our CEO, our CFO, our Chief People Officer, and our executive compensation staff to formulate recommendations with respect to specific compensation actions. The LDEIC committee makes all final decisions regarding compensation for our executive officers, including base salary levels, target annual cash bonus opportunities, actual cash bonus payments, and long-term incentives in the form of equity awards. The LDEIC committee periodically reviews compensation matters with our Board. The LDEIC committee meets on a regularly-scheduled basis and at other times as needed. The LDEIC committee met four times during 2023.

Each year, the LDEIC committee reviews our executive compensation program, including any incentive compensation plans and arrangements, to assess whether our compensation elements, actions, and decisions are (i) properly coordinated, (ii) aligned with our vision, mission, values, and corporate goals, (iii) provide appropriate short-term and long-term incentives for our executive officers, (iv) achieve their intended purposes, and (v) are competitive with the compensation of executives in comparable positions at the companies with which we compete for executive talent. Following this assessment, the LDEIC committee makes any necessary or appropriate modifications to our existing plans and arrangements or adopts new plans or arrangements.

To understand the competitive market in which we compete for talent, the LDEIC committee periodically reviews and analyzes market trends and the prevalence of various compensation delivery vehicles and adjusts the design and operation of our executive compensation program from time to time as it deems necessary and appropriate. In designing and implementing the various elements of our executive compensation program, the LDEIC committee considers market and industry practices, as well as the tax efficiency of our compensation structure and its impact on our financial condition. While the LDEIC committee considers numerous factors in its deliberations, it places no formal weighting on any one factor.

The LDEIC committee also conducts an annual review of our executive compensation strategy to ensure that it is appropriately aligned with our business strategy and achieving our desired objectives.

The factors considered by the LDEIC committee in determining the compensation of our executive officers for 2023 included:

•the recommendations of our CEO (except with respect to his own compensation as described below);

•our overall corporate growth and other elements of financial performance;

•our overall corporate achievements against one or more short-term performance objectives;

•the individual performance of each executive officer;

•a review of the relevant competitive market analysis prepared by its compensation consultant (as described below);

| | | | | | | | |

| Coursera | 42 | 2024 Proxy Statement |

•the expected future contribution of the individual executive officers;

•historical compensation awards of the individual executive officers; and

•internal pay equity between our executive officers.

For 2023, the LDEIC committee did not weigh these factors in any predetermined manner, nor did it apply any formulas in making its decisions. The members of the LDEIC committee considered this information in light of their individual experience, knowledge of the Company, knowledge of each executive officer, knowledge of the competitive market, and business judgment in making their decisions regarding executive compensation and our executive compensation program.

As part of this process, the LDEIC committee also evaluates the performance of our CEO each year and makes all decisions regarding base salary adjustments, target annual cash bonus opportunities, actual cash bonus payments, and long-term incentives in the form of equity awards. Our CEO is not present during any of the deliberations regarding his compensation.

Role of our CEO

Our CEO works closely with the LDEIC committee to structure the compensation program for our other executive officers. Our CEO also makes recommendations to the LDEIC committee as described in the following paragraph and is involved in the determination of compensation for the respective executive officers who report to him.

At the beginning of each year, our CEO reviews the performance of our other executive officers for the previous year, and then shares these evaluations with, and makes recommendations to, the LDEIC committee for each element of compensation, including base salary adjustments, target annual cash bonus opportunities, and long-term incentives in the form of equity awards for each of our executive officers based on our results, the individual executive officer’s contribution to these results and performance toward achieving their individual performance goals, and the market data from the independent compensation consultant. The LDEIC committee then reviews these recommendations, considers the other factors described above, and makes decisions as to the target total direct compensation of each executive officer (other than our CEO), as well as each individual compensation element.

While the LDEIC committee considers our CEO’s recommendations, as well as the competitive market analysis prepared by its compensation consultant, these recommendations and market data serve as only two of several factors in making its decisions with respect to the compensation of our executive officers. Ultimately, the LDEIC committee applies its own business judgment and experience to determine the individual compensation elements and amount of each element for our executive officers. No executive officer participates in the determination of the amounts or elements of their own compensation.

Role of Compensation Consultant

Pursuant to its charter, the LDEIC committee has the authority to engage its own legal counsel and other advisors, including compensation consultants, as it determined in its sole discretion, to assist in carrying out its responsibilities. The LDEIC committee makes all determinations regarding the engagement, fees, and services of these advisors, and any such advisor reports directly to the LDEIC committee.

For 2023, the LDEIC committee continued to engage Compensia, a national compensation consulting firm, to provide information, analysis, and other assistance relating to our executive compensation program on an ongoing basis. The nature and scope of the services provided to the LDEIC committee by Compensia with respect to Coursera’s 2023 compensation program were as follows:

•reviewed and recommended updates to our compensation peer group;

•provided advice with respect to compensation best practices and market trends for our executive officers and Board members;

•analyzed levels of overall compensation and each element of compensation of our executive officers;

| | | | | | | | |

| Coursera | 43 | 2024 Proxy Statement |

•analyzed levels of overall compensation and each element of compensation for our Board members;

•conducted an executive compensation risk analysis;

•conducted an analysis of our CEO pay ratio and pay versus performance disclosures for this Proxy Statement;

•reviewed this Compensation Discussion and Analysis and other disclosures in this Proxy Statement; and

•provided ad hoc advice and support throughout the year.

A representative of Compensia attends meetings of the LDEIC committee as requested and may also communicate with the LDEIC committee outside of meetings. Compensia reports to the LDEIC committee rather than to management, although Compensia may meet with members of management, including our CEO and members of our executive compensation staff, for purposes of gathering information on proposals that management may make to the LDEIC committee and providing them with market data to assist them in developing their proposals. Throughout 2023, Compensia met with various members of management to collect data and discuss management’s executive compensation proposals.

The LDEIC committee may replace its compensation consultant or hire additional advisors at any time. Compensia has not provided any other services to Coursera and has not received any compensation other than with respect to the services for the benefit of the LDEIC committee.

The LDEIC committee has assessed the independence of Compensia taking into account, among other things, the various factors as set forth in Exchange Act Rule 10C-1 and the enhanced independence standards and factors set forth in the applicable listing standards of the NYSE, and has concluded that Compensia is independent and that the work of Compensia on behalf of the LDEIC committee has not raised any conflict of interest.

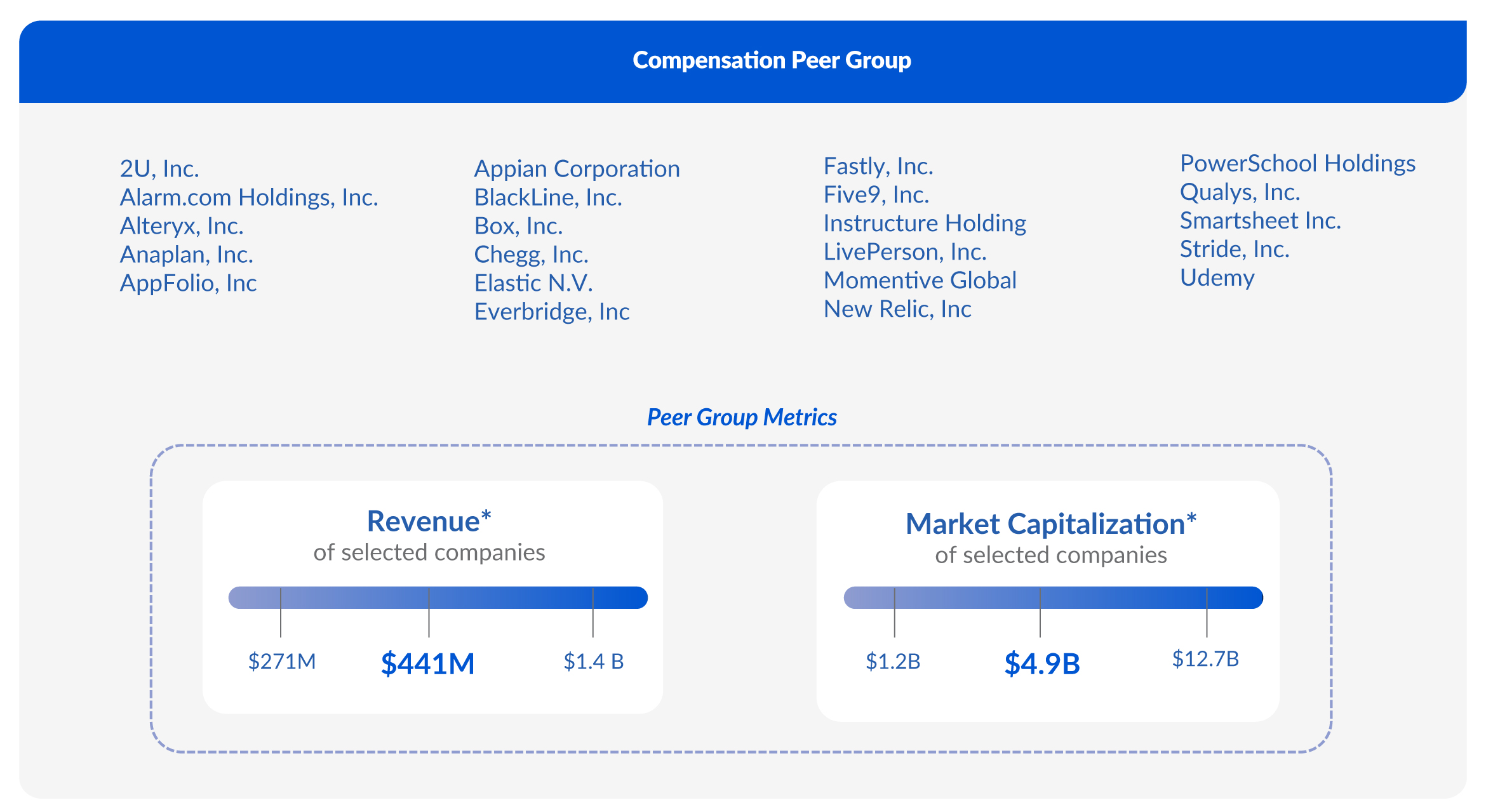

Competitive Positioning

Given our unique history and business, market competitors, and geographical location, the LDEIC committee believes that the competitive market for executive talent is composed of U.S. technology companies, with a focus on technology companies providing education services. Accordingly, the LDEIC committee develops a compensation peer group to contain a carefully-selected cross-section of such public companies using factors described below, with revenue and market capitalization that are similar to ours. This data is supplemented with executive compensation survey data representing both public and private technology companies of similar revenue and market capitalization. The LDEIC committee considers the compensation practices of these peer group companies as one factor in its compensation deliberations.

Compensation Peer Group

As part of its deliberations, the LDEIC committee considers competitive market data on executive compensation levels and practices and a related analysis of such data. This data is drawn from a select group of peer companies developed by the LDEIC committee, as well as compensation survey data.

In 2022, in preparation for the annual review of executive compensation in the first quarter of 2023, the LDEIC committee directed Compensia to review, and if appropriate, propose updates to its group of peer companies. These peer companies were to be used as a reference for market positioning and for assessing competitive market practices. Compensia undertook a detailed review of the pool of U.S.-based publicly traded companies, taking into consideration our industry sector, the size of such companies (based on revenues and market capitalization) relative to our size, and growth rate. Following this review, Compensia recommended to the LDEIC committee the following peer group consisting of 22 publicly traded educational services and software companies, which the LDEIC committee subsequently approved.

| | | | | | | | |

| Coursera | 44 | 2024 Proxy Statement |

* Represents the revenue and market capitalization ranges of our peer group companies at the time of the LDEIC committee’s approval of the peer group in 2022.

This compensation peer group was used by the LDEIC committee in connection with its annual review of our executive compensation program for 2023 in the second half of 2022. Specifically, the LDEIC committee reviewed the compensation data drawn from the compensation peer group, in combination with industry-specific compensation survey data from Radford Aon to develop a subjective representation of the “competitive market” with respect to current executive compensation levels and related policies and practices. The LDEIC committee then evaluated how our pay practices and the compensation levels of our executive officers compared to the competitive market. As part of this evaluation, the LDEIC committee also reviewed the performance measures and performance goals generally used within the competitive market to reward performance.

Compensation peer group information is one of several factors that the LDEIC committee considers in making its decisions with respect to the compensation of our executive officers. However, we do not believe that it is appropriate to make compensation decisions, whether regarding base salaries or short-term or long-term incentive compensation, solely upon any type of benchmarking to a peer or other representative group of companies. The LDEIC committee believes that information regarding the compensation practices at other companies is useful in at least two respects. First, the LDEIC committee recognizes that our compensation policies and practices must be competitive in the marketplace. Second, this information is useful in assessing the reasonableness and appropriateness of individual executive compensation elements and of our overall executive compensation packages.

| | | | | | | | |

| Coursera | 45 | 2024 Proxy Statement |

Compensation Elements

The three primary elements of our executive compensation programs are: (1) base salary, (2) annual cash bonus opportunities, and (3) long-term incentives in the form of equity awards, as described below:

| | | | | | | | | | | |

| Compensation Element | What This Element Rewards | | Purpose and Key Features of Element |

| | | |

| | | |

| Base Salary | Individual performance and relative contributions and responsibilities, level of experience, expected future performance, and contributions | | Provides competitive level of fixed compensation determined by the market value of the position, with actual base salaries established based on the facts and circumstances of each executive officer and each individual position |

| | | |

| Annual Cash Bonus Opportunities | Achievement of pre-established corporate performance objectives | | Motivates executive officers to achieve our key business objectives for the year Performance objectives are established to incent our executive officers to achieve or exceed performance objectives. For 2023, payouts for corporate performance objectives could range from 0% to 150% for each objective, depending on actual achievement; actual 2023 bonuses were earned at 82.6% of target under the 2023 Executive Incentive Compensation Plan |

| | | |

| Equity Awards (Long-Term Incentives) | Achievement of long-term stockholder value and to attract, retain, motivate, and reward executive officers over extended periods for successful corporate performance Multi-year vesting requirements promote retention of highly-valued executive officers | | Encourages creation and maintenance of long-term stockholder value because the ultimate value of these equity awards is directly related to the market price of our common stock, and the awards vest over an extended period of time Equity awards generally vest over multiple years, provide a variable “at risk” pay opportunity, and serve to focus management on long-term value creation while also attracting, retaining, motivating, and rewarding executive officers |

Our executive officers are also eligible to participate in the standard employee benefit plans available to most of our employees (depending on location). In addition, our executive officers are eligible for post-employment (severance and change in control) payments and benefits under limited circumstances. Each of these compensation elements is discussed in detail below, including a description of the particular element and how it fits into our overall executive compensation and a discussion of the amounts of compensation paid to our NEOs in 2023 under each of these elements. Variable pay elements ensure that, each year, a substantial portion of our executive officers’ target total direct compensation is contingent (rather than fixed) in nature, with the amounts ultimately payable subject to variability based on our performance.

Base Salary

We believe that a competitive base salary is a necessary element of our executive compensation program that enables us to attract and retain a stable management team. Base salaries for our executive officers are intended to be competitive with those received by other individuals in similar positions at the companies with which we compete for talent, as well as equitable across the executive team.

Generally, we establish the initial base salaries of our executive officers through arm’s-length negotiation at the time we hire the individual executive officer, taking into account the executive’s position, qualifications, experience, prior salary level, expected contributions, market data, and the base salaries of our other executive officers. Thereafter, the LDEIC committee reviews the base salaries of our executive officers annually and makes adjustments to base salaries as it determines to be necessary or appropriate. No executive officers are entitled to any automatic base salary increases, and all base salary increases are determined by the LDEIC committee at its discretion.

As part of its annual review of our executive officers’ base salaries, the LDEIC committee took into consideration a competitive market analysis performed by Compensia and the recommendations of our CEO (except with respect to his own base salary), as well as the other factors described above. Following this review, the LDEIC committee determined to provide merit increases to Mr. Hahn and

| | | | | | | | |

| Coursera | 46 | 2024 Proxy Statement |

Mr. Cardenas in the amounts of 5.1% and 3.0% of base salary, respectively, effective as of March 1, 2023. Mr. Cardenas’ base salary was thereafter increased to $380,000, effective as of May 24, 2023, in connection with his promotion to General Counsel. At our CEO’s request, his base salary has not increased since he joined us in 2017.

The base salaries of our NEOs as of December 31, 2023 and 2022 were as follows:

| | | | | | | | | | | | | | |

| Named Executive Officer | Base Salary at December 31, 2023 ($) | Base Salary at December 31, 2022 ($) | Percentage

Increase

(%) | |

| | | | |

| Jeffrey N. Maggioncalda | 400,000 | | 400,000 | | — | % | |

| Kenneth R. Hahn | 431,000 | | 410,000 | | 5.1 | % | |

| Shravan K. Goli | 473,000 | | 473,000 | | — | % | |

| Leah F. Belsky | 426,000 | | 426,000 | | — | % | |

Alan Cardenas(1) | 380,000 | | 324,800 | | 17.0 | % | |

1. Mr. Cardenas’ base salary was increased to $334,544 effective March 1, 2023 as a merit increase. Effective May 24, 2023, his base salary was increased to $380,000 in connection with his promotion to General Counsel.

Annual Cash Incentive Bonus Opportunity

We use annual cash bonus opportunities to motivate our executive officers to achieve our short-term financial and operational objectives while making progress towards our longer-term growth and other goals. Consistent with our executive compensation philosophy, these annual bonuses are intended to help us to deliver a competitive total direct compensation opportunity to our executive officers. Annual cash bonuses are entirely performance-based, are not guaranteed, and may vary materially from year-to-year.

The LDEIC committee establishes annual cash incentive bonus opportunities pursuant to our executive incentive compensation plans designed to reward our executive officers for achieving predetermined corporate performance targets over our fiscal year. The annual cash bonus opportunities are designed to pay above-target bonuses when we exceed our annual corporate objectives and below-target bonuses when we do not achieve these objectives. All of our NEOs were eligible to participate in the 2023 Executive Incentive Compensation Plan.

Under the 2023 Executive Incentive Compensation Plan, the LDEIC committee has the authority to determine the performance measures and related target levels applicable to the annual cash bonus opportunities for our executive officers. The performance measures involving our financial results could be determined in accordance with U.S. generally accepted accounting principles (“GAAP”), or such financial results could consist of non-GAAP financial measures, and any actual results are subject to adjustment by the LDEIC committee for one-time items or unbudgeted or unexpected items when determining whether the target levels for the performance measures have been met. Individual performance objectives could be established on the basis of any factors the LDEIC committee determines relevant, and are subject to adjustment on an individual, divisional, business unit, or company-wide basis.

Under the 2023 Executive Incentive Compensation Plan, the LDEIC committee could, in its sole discretion and at any time, increase, reduce, or eliminate a participant’s actual bonus payment, and/or increase, reduce, or eliminate the amount the Company allocates to the bonus pool for the year. Further, any bonus paid under the 2023 Executive Incentive Compensation Plan could be below, at, or above a participant’s target bonus opportunity, in the LDEIC committee’s sole discretion. The LDEIC committee could determine the amount of any reduction on the basis of such factors as it deemed relevant, and it was not required to establish any allocation or weighting with respect to the factors it considered.

| | | | | | | | |

| Coursera | 47 | 2024 Proxy Statement |

2023 Target Cash Bonus Opportunities

After reviewing comparative data of the percentages of pay that is at risk for comparable officers at the companies in our compensation peer group, the LDEIC committee approved the following target annual cash bonus opportunities for each of our NEOs under the Executive Incentive Plan for 2023, expressed as a percentage of annual base salary. All of the NEOs maintained the same annual cash incentive bonus target percentages for 2023 as in 2022 except for Mr. Cardenas whose target percentage increased in May 2023 in connection with his promotion to General Counsel.

| | | | | | | | | | | |

| Named Executive Officer | 2023 Target Cash Bonus Opportunity (as a percentage of base salary) (%) | 2023 Target Cash Bonus Opportunity ($) | |

| | | |

| Jeffrey N. Maggioncalda | 63 | | 252,000 | |

| Kenneth R. Hahn | 70 | | 301,700 | |

| Shravan K. Goli | 80 | | 378,400 | |

Leah F. Belsky(1) | 100 | | 426,000 | |

Alan Cardenas(2) | 50 | | 154,518 | |

1.Ms. Belsky’s target cash bonus opportunity under the 2023 Executive Incentive Plan was 100% of base salary in connection with the LDEIC’s decision that she only participate in the 2023 Executive Incentive Compensation Plan and not any other commissions-based bonus plans. For 2022, Ms. Belsky had been eligible to receive target cash bonus opportunities for up to 100% of her base salary comprised of (i) 25% target cash bonus opportunity under the 2022 Executive Incentive Compensation Plan, and (ii) 75% target cash bonus opportunity under the 2022 Enterprise Incentive Plan that included commission-based cash bonus payments upon the achievement of certain enterprise financial targets.

2.Mr. Cardenas’ target cash bonus opportunity increased from 30% to 50% of base salary effective as of May 24, 2023, in connection with his promotion to General Counsel, and the dollar amount of his 2023 target cash bonus opportunity was prorated to reflect the adjustments in 2023 to his salary and target bonus percentages.

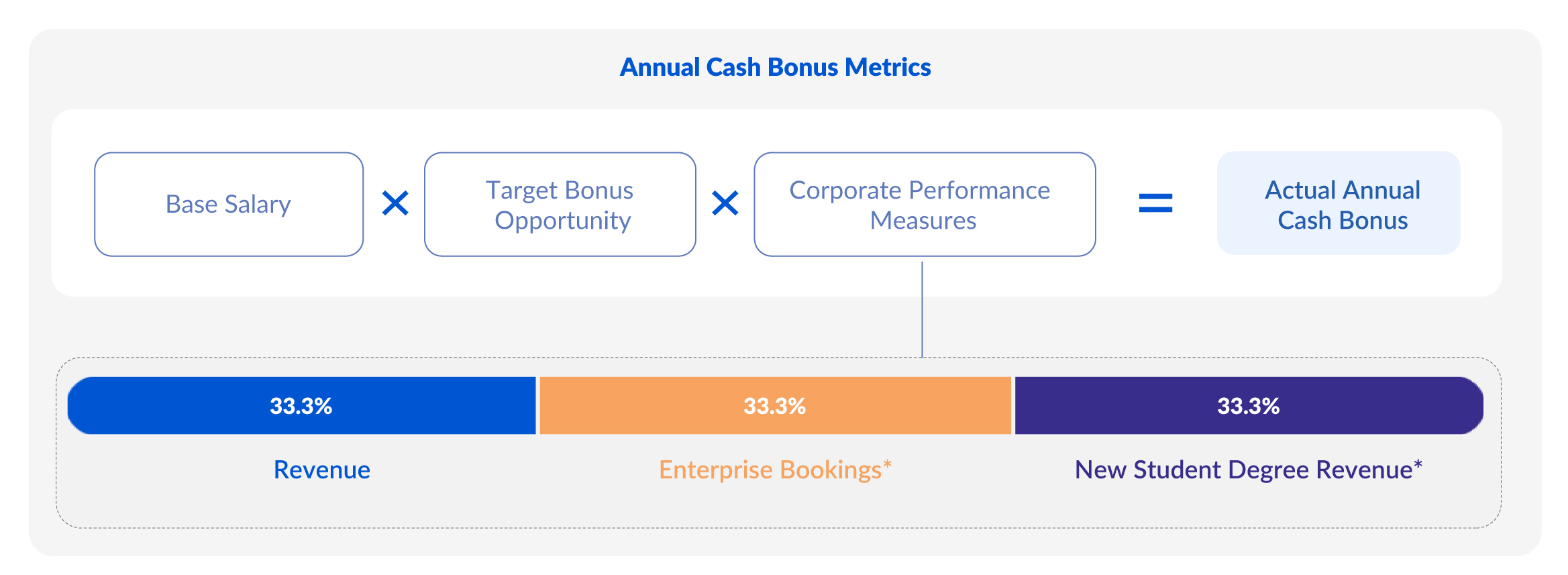

Corporate Performance Measures, Targets, Results, and Bonus Decisions

Our executive officers’ target annual cash bonus opportunities under our 2023 Executive Incentive Compensation Plan are determined solely based on the corporate performance objectives discussed below (subject to any exercise of LDEIC committee discretion, which it did not elect to exercise during 2023). The LDEIC committee determined that the 2023 target cash bonus opportunity allocations were appropriate to focus our executive officers on our short-term financial objectives as reflected in our annual operating plan. In February 2023, the LDEIC committee approved the following corporate performance measures under the 2023 Executive Incentive Plan:

•“Revenue”: Coursera’s total annual revenue based on GAAP as disclosed in the Annual Report;

•“Enterprise Bookings”: annual contract dollar value of new, upsell, or cross-sell Coursera for Business, Coursera for Campus, and Coursera for Government contracts closed during the year ended December 31, 2023; and

•“New Student Degree Revenue”: revenue attributable to students who enrolled in a degree program for the first time in 2023, and in which the academic term also commenced in 2023.

| | | | | | | | |

| Coursera | 48 | 2024 Proxy Statement |

* Enterprise Bookings and New Student Degree Revenue are non-GAAP financial measures for which there is no comparable GAAP measure.

The metrics selected for 2023 were similar to those used in 2022, although the LDEIC committee determined that Enterprise Bookings and New Student Degrees Revenue (as compared to the Coursera for Campus ACV and New Enrolled Degree Students metrics used in 2022) better aligned with our 2023 strategic growth goals. For each performance measure, the LDEIC committee established challenging and rigorous thresholds, target, and maximum levels of achievement that required significant growth compared to prior year actual results to achieve at the target level. We do not publicly disclose Enterprise Bookings or New Degree Student Revenue as we believe this information is competitively sensitive. Accordingly, we do not publicly disclose the specific targets for these two metrics, but have endeavored to provide information in this discussion as to the challenging nature of these goals and the level of our achievement for 2023.

Each of the corporate performance measures were equally weighted. The LDEIC committee believed these performance measures were appropriate for our business because they focused on overall growth in company revenue and specific strategic business initiatives, both of which it believes directly influence long-term stockholder value. In February 2023, the LDEIC committee established the following minimum, target, and maximum levels of achievement for the corporate performance measures and their respective payment amounts, with the actual bonus payment with respect to each measure to be determined independently. The LDEIC committee believed that satisfaction of the minimum, target, and maximum levels of achievement for each of the corporate performance measures would require significant growth. In the event of actual performance between the threshold and target, and target and maximum, performance levels, the payment amount was to be calculated between each designated segment on a linear basis.

| | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Performance Measure | Threshold Performance Level (Achievement %) | Threshold Payment Level (% of Target Payout) | Target Performance Level

(%) | Target

Payment

Level

(%) | Maximum Performance Level

(%) | Maximum Payment

Level

(%) | |

| | | | | | | |

| Revenue | 75 | | 50 | | 100 | | 100 | | ≥125 | 150 | | |

| Enterprise Bookings | 75 | | 50 | | 100 | | 100 | | ≥125 | 150 | | |

| New Student Degree Revenue | 60 | | 50 | | 100 | | 100 | | ≥125 | 150 | | |

| | | | | | | | |

| Coursera | 49 | 2024 Proxy Statement |

In January 2024, the LDEIC committee determined that our actual achievement with respect to the corporate financial objectives under the 2023 Executive Incentive Compensation Plan for revenue, as compared with the target, was as follows:

| | | | | | | | | | | | | | |

| Corporate Performance Measure | 2023 Target Level (in $ millions) | 2023 Actual Result (in $ millions | 2023 Percent Achieved (%) | |

| | | | |

| Revenue | 620.2 | 635.8 | 102.5 | | |

In January 2024, the LDEIC committee also determined that our actual performance of the Enterprise Bookings and New Student Degree Revenue performance measures in 2023 had been 82.4% and 82.5%, respectively. As a result, the LDEIC committee awarded the achievement of the Enterprise Bookings performance and New Student Degree Revenue at 64.8% and at 78.1% payment levels, respectively.

Accordingly, the LDEIC committee determined that, based on our actual performance with respect to each corporate performance measure, the corporate performance objectives had been achieved, in the aggregate, at 82.6% under the 2023 Executive Incentive Compensation Plan.

* In the event of actual performance between the threshold and target, and target and maximum, performance levels, the payment amount will be calculated between each designated segment on a linear basis.

Accordingly, the LDEIC committee approved bonus payments as follows for our named executive officers:

| | | | | | | | | | | | | | |

| Named Executive Officer | 2023 Target Annual Bonus ($) | Actual Payout as a Percentage of 2023 Annual Target Bonus (%) | Actual Annual

Cash Bonus Payment

($) | |

| | | | |

| Jeffrey N. Maggioncalda | 252,000 | 82.6 | | 206,500 | |

| Kenneth R. Hahn | 301,700 | 82.6 | | 249,204 | |

| Leah F. Belsky | 426,000 | 82.6 | | 351,876 | (1) |

| Alan B. Cardenas | 154,518 | 82.6 | | 127,633 | |

| Shravan K. Goli | 378,400 | 82.6 | | 312,558 | |

| | | | | | | | |

| Coursera | 50 | 2024 Proxy Statement |

Equity Awards (Long-Term Incentive Compensation)

Our LDEIC committee grants long-term incentive compensation in the form of equity awards to motivate and retain our executive officers, attract key talent, retain and align their interests with that of our stockholders. Equity awards enable us to provide our executive officers with the opportunity to build an equity interest in Coursera and to share in the potential appreciation of the value of our common stock. Over time, the equity vehicles we have used to incentive our executive officers have evolved. Prior to our IPO, we relied on options to purchase shares of our common stock to incentivize our executive officers. Beginning in 2019, including leading up to our IPO, we began granting RSUs that may be settled for shares of our common stock as the principal vehicles for delivering long-term incentive compensation opportunities to our executive officers.

No Equity Awards Granted in 2023 to our NEOs (except for Mr. Cardenas in connection with his promotion)

In most years, equity compensation comprises a majority of our executive officers’ target total direct compensation opportunities. These awards are aimed at rewarding our executive officers over a multi-year period. In 2022, the LDEIC committee granted certain equity awards that were significantly larger than typical annual awards. As previously disclosed, our 2022 equity awards included a “catch up” equity grant component for our CEO to align his unvested equity holdings within the range of our peer group and to provide an appropriate retention benefit. In 2022, we also granted an equity award to each of Mr. Goli and Ms. Belsky in recognition of their promotions and increased responsibilities that year. The LDEIC committee viewed these grants as essential to adequately motivate performance and achieve our retention objectives, but recognized that the size of the grants in 2022 were larger than a typical annual grant.

In light of the significant grants made to our CEO, Mr. Goli, and Ms. Belsky in 2022, the LDEIC committee and management determined not to grant equity awards to our NEOs in 2023 other than to Mr. Cardenas in connection with his promotion to General Counsel, and determined to return to a more typical grant cycle thereafter, beginning in 2024. In 2023, Mr. Cardenas was granted the following equity awards in connection with his promotion to General Counsel on May 24, 2023:

| | | | | | | | | | | |

| Named Executive Officer | RSU Awards

(number of shares)

(#) | Option Awards (number of shares) (#) | |

| | | |

Alan B. Cardenas(1) | 67,568 | 135,136 | |

1. The RSU and stock option awards granted to Mr. Cardenas vest in quarterly installments over four years beginning August 15, 2023, subject to Mr. Cardenas’ continued employment with Coursera on each such vesting date.

We resumed equity grants to our executive officers (except for our CEO who declined to receive any equity award in 2024), in the first quarter of 2024 and plan to grant annual refresh equity awards to our executives, including our CEO, beginning in the first quarter of 2025.

2024 PSU Program

After carefully considering stockholder feedback, as summarized above, the LDEIC committee introduced PSUs as a component of our long-term incentive compensation program for our executive officers. In March 2024, our NEOs, other than our CEO, were granted PSUs pursuant to which the number of shares eligible to be earned under such PSUs will be determined based on Coursera’s achievement of revenue for 2024 and will be determined following the filing of our Annual Report on Form 10-K for the fiscal year ending December 31, 2024. Shares under the PSU awards that become eligible to vest, if any, based on achievement of revenue will be subject to time-based vesting with 25% vesting on February 15, 2025 and 6.25% vesting on each company designated quarterly vesting date thereafter, subject to the applicable NEO’s continuous service with us through each quarterly vesting date. The PSUs granted to our NEOs in 2024 (except for our CEO who declined to receive any equity award in 2024) are expected to represent 25% of each such NEO’s equity compensation for 2024.

| | | | | | | | |

| Coursera | 51 | 2024 Proxy Statement |

For 2024, the LDEIC committee selected revenue as the performance metric for the PSUs, since at this stage of our maturity, it views revenue growth as the single most important metric indicative of our long-term success and therefore long-term value creation for our stockholders. Further, given the rapidly evolving nature of our business as we grow, the LDEIC committee believes that the performance measure for the 2024 PSU program, which is based upon our fiscal year 2024 performance, was necessary to provide the line of sight necessary to set a challenging yet potentially achievable performance goals to promote Coursera’s long-term success and increase stockholder alignment and value.

In determining the amount of each NEO’s equity award for 2024 (except for our CEO who declined to receive any equity award in 2024), the LDEIC committee took into consideration the recommendations of our CEO, our recent financial results, Coursera’s performance, and each executive officer’s individual performance, as well as retention considerations. As we mature as a public company, we intend that our long-term incentive compensation program will continue to evolve to reflect our executive compensation philosophy and objective of rewarding strong performance with competitive and incentivizing compensation, which may include increasing the proportion of equity awards that vest based on performance or adjusting the metrics used for performance-based equity. We will continue to review the mix of PSUs and RSUs in future years with the goal of increasing the weighting of PSUs to align with market norms. We will also periodically review the PSU performance metric(s) and the length of the performance period.

Other Compensation Policies

Company Benefits

Coursera’s benefits are an important tool in our ability to attract and retain outstanding employees. As a business matter, we weigh the benefits we need to offer to remain competitive and attract and retain talented employees against the cost of the benefits. Benefit levels are reviewed periodically to ensure they are cost-effective and competitive and support the overall needs of Company employees. This section describes the benefits that Coursera provides to our executives.

Company-Sponsored Retirement Plan

The Coursera 401(k) Plan (the “401(k) Plan”) is a tax-qualified defined contribution plan that is designed to comply with the Employee Retirement Income Security Act of 1974, as well as federal and state legal requirements. The 401(k) Plan provides retirement benefits to eligible Coursera employees. Eligible employees, including Coursera’s executive officers, may elect to contribute to the 401(k) Plan through salary reduction up to the yearly maximum tax-deductible deferral allowed pursuant to applicable tax regulations. All participants’ interests in their deferrals are 100% vested when contributed under the plan. In 2022, we began providing a dollar-for-dollar Company matching contribution equal to up to 3% of a participant’s semi-monthly salary, up to a maximum of $2,500 annually. Contributions are allocated to each participant’s individual account under the 401(k) Plan and are invested in selected investment alternatives according to the participants’ directions.

We do not provide employees, including our executive officers, any other retirement benefits, including but not limited to tax-qualified defined benefit plans (pension plans), supplemental executive retirement plans, or nonqualified defined contribution plans.

Welfare and Health Benefits

We provide health and welfare benefits to our executive officers, on the same basis as all of our full-time employees. These benefits generally include health, dental, vision benefits, health and dependent care flexible spending accounts, short-term and long-term disability insurance, accidental death and dismemberment insurance, and basic life insurance coverage. We also provide vacation and other paid holidays to all employees, including our executive officers.

Perquisites and Other Personal Benefits

We do not provide perquisites or other personal benefits to our executive officers.

| | | | | | | | |

| Coursera | 52 | 2024 Proxy Statement |

Employee Stock Purchase Plan

We maintain our 2021 Employee Stock Purchase Plan (“ESPP”), which is a tax-qualified employee stock purchase plan that offers all eligible employees, including Coursera’s executive officers, the opportunity to acquire an ownership interest in Coursera by purchasing shares of our common stock at a discount through the ESPP.

Employment Arrangements with our Named Executive Officers

We have extended and entered into written employment offer letters to each of our executive officers, including our CEO and our other NEOs. Each of these arrangements was approved on our behalf by our Board or the LDEIC committee, as applicable. We believe that these arrangements were appropriate to induce these individuals to forego other employment opportunities or leave their current employer for the uncertainty of a demanding position in a new and unfamiliar organization. At the same time, in formulating these compensation packages, we were sensitive to the need to integrate these individuals into the executive compensation structure, balancing both competitive and internal equity considerations. Each of these employment arrangements provides for “at will” employment and sets forth the initial compensation arrangements for the executive officer.

Post-Employment Compensation

We believe that having in place reasonable and competitive post-employment compensation arrangements, including in the event of a change in control of Coursera, are essential to attracting and retaining highly qualified executive officers. We maintain a severance plan for certain eligible executives, including our NEOs (our “Executive Severance Plan”), pursuant to which they may become eligible to receive severance and change in control benefits in certain situations.

We believe that our Executive Severance Plan serves several key objectives by (i) incentivizing our executive officers to remain employed and focused on their responsibilities during the threat or negotiation of a change-in-control transaction, which preserves our value and the potential benefit to be received by our stockholders in the transaction, (ii) creating an equitable program based on the executive’s level of responsibility and tenure, and (iii) reducing administrative costs by eliminating the need to negotiate separation payments and benefits on a case-by-case basis. For a summary of the material terms and conditions of our severance arrangements, as well as the post-employment compensation arrangements with our NEOs, see “—Potential Payments upon Termination or Change in Control” below.

Compensation Recovery Policy

We have long maintained a compensation recoupment policy. We amended our Senior Executive Compensation Recoupment Policy ("the clawback policy"), effective as of October 2, 2023, that provides for the recoupment of erroneously awarded incentive compensation paid to current and former executive officers in the event of an accounting restatement due to material noncompliance with financial reporting requirements in accordance with the listing standards of the NYSE and Exchange Act Rule 10D-1. The clawback policy applies to compensation that is granted, earned, or vested based in whole or in part upon the attainment of a financial reporting measure and provides for the reimbursement or forfeiture by the executive officer of the excess portion of the compensation received by the executive officers during the three preceding fiscal years.

Insider Trading, Derivatives Trading, Hedging, and Pledging Policies

We have adopted a policy prohibiting our employees, including our executive officers, and Board members from speculating in our equity securities, including the use of short sales, “sales against the box”, or any equivalent transaction involving our equity securities. In addition, they may not engage in any other hedging transactions, such as “cashless” collars, forward sales, equity swaps, and other similar or related arrangements, with respect to the securities that they hold. Finally, no employee, including an executive officer or Board member may acquire, sell, or trade in any interest or position relating to the future price of our equity securities.

Our policy also prohibits our employees, including our executive officers, and Board members from (i) pledging our common stock and (ii) trading shares of our common stock when the person is aware of material nonpublic information. Our policy further restricts

| | | | | | | | |

| Coursera | 53 | 2024 Proxy Statement |

directors, executive officers, and certain other employees determined to have potential access to insider information from trading in Company stock during predetermined closed periods.

Tax and Accounting Considerations

Deductibility of Executive Compensation

Section 162(m) of Internal Revenue Code of 1986, as amended, (the “Code”) generally places a $1 million limit on the amount of compensation a public company can deduct in any one year for certain current and former executive officers. While our LDEIC committee considers tax deductibility as one factor in determining executive compensation, our LDEIC committee also looks at other factors in making its decisions, as noted above, and retains the flexibility to award compensation that it determines to be consistent with the goals of our executive compensation program, even if the awards are not deductible by us for tax purposes.

Taxation of Nonqualified Deferred Compensation

Section 409A of the Code requires that amounts that qualify as “nonqualified deferred compensation” satisfy requirements with respect to the timing of deferral elections, timing of payments, and certain other matters. Generally, the LDEIC committee intends to administer our executive compensation program and design individual compensation components, as well as the compensation plans and arrangements for our employees, so that they are either exempt from, or satisfy the requirements of, Section 409A. From time to time, we may be required to amend some of our compensation plans and arrangements to ensure that they are either exempt from, or compliant with, Section 409A.

Taxation of “Parachute” Payments

Sections 280G and 4999 of the Code provide that executive officers and directors who hold significant equity interests and certain other service providers may be subject to additional taxes if they receive payments or benefits in connection with a change in control of Coursera that exceeds certain prescribed limits, and that we (or a successor) may forfeit a deduction on the amounts subject to this additional tax. We did not provide any executive officer with a “gross-up” or other reimbursement payment for any tax liability owed as a result of the application of Sections 280G or 4999 during 2022, and we have not agreed and are not otherwise obligated to provide any executive officers with such a “gross-up” or other reimbursement payment.

Accounting for Stock-Based Compensation

The LDEIC committee considers accounting implications when designing compensation plans and arrangements for our executive officers and other employees. Chief among these is ASC 718, the standard that governs the accounting treatment of stock-based compensation awards.

ASC 718 requires us to recognize in our financial statements all share-based payment awards to employees, including grants of options to purchase shares of our common stock and restricted stock units and awards for shares of our common stock to our executive officers, based on their fair values. The application of ASC 718 involves judgment in the determination of inputs into the Black-Scholes-Merton valuation model that we use to determine the fair value of stock options. These inputs are based upon assumptions as to the volatility of the underlying stock, risk free interest rates, and the expected life (term) of the stock options. As required under GAAP, we review our valuation assumptions at each grant date, and, as a result, our valuation assumptions used to value stock options granted in future periods may vary from the valuation assumptions we have used previously. For performance-based equity awards, we also must apply judgment in determining the periods when, and if, the related performance targets become probable of being met.

ASC 718 also requires us to recognize the compensation cost of our stock-based payment awards in our income statement over the period that an employee, including our executive officers, is required to render service in exchange for the award (which, generally, will correspond to the award’s vesting schedule).

| | | | | | | | |

| Coursera | 54 | 2024 Proxy Statement |

LDEIC Committee Report

The following report of the LDEIC committee shall not be deemed to be “soliciting material” or “filed” with the SEC or to be incorporated by reference into any other filing by Coursera, Inc. under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that we specifically incorporate it by reference into a document filed under those Acts.

The LDEIC committee has reviewed and discussed with management the Compensation Discussion and Analysis contained in this Proxy Statement. Based upon its review and those discussions, the LDEIC committee recommended to our board of directors that the Compensation Discussion and Analysis be included in this Proxy Statement.

Leadership, Development, Equity, Inclusion, and Compensation Committee

Carmen Chang (Chair)

Amanda M. Clark

Susan W. Muigai

Scott D. Sandell

| | | | | | | | |

| Coursera | 55 | 2024 Proxy Statement |

Executive Compensation Tables

Summary Compensation Table

The following table sets forth information concerning the total compensation of

the following persons, whom we refer to as our

named executive officers: (i) our Chief Executive OfficerNEOs in 2023, 2022, and

(ii) our next two most highly compensated executive officers on December 31, 2021.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and principal position | | Fiscal

Year | | | Salary

($) | | | Stock

Awards

($)(1) | | | Option

Awards

($)(1) | | | Non-Equity

Incentive Plan

Compensation

($)(2) | | | All Other

Compensation

($)(3) | | | Total

($) | |

Jeffrey N. Maggioncalda President and Chief Executive Officer | | | 2021 | | | | 400,000 | | | | 2,260,346 | | | | 2,446,721 | | | | 272,300 | | | | 315 | | | | 5,379,682 | |

| | | 2020 | | | | 400,000 | | | | 6,592,857 | | | | 7,598,911 | | | | 322,500 | | | | 315 | | | | 14,914,583 | |

Kenneth R. Hahn Senior Vice President, Chief Financial Officer, Treasurer | | | 2021 | | | | 370,833 | | | | 1,356,208 | | | | 1,468,033 | | | | 235,993 | | | | 315 | | | | 3,431,382 | |

| | | 2020 | | | | 218,750 | | | | 1,727,443 | | | | 5,780,574 | | | | 141,094 | | | | 315 | | | | 7,868,176 | |

Leah F. Belsky Senior Vice President and Chief Enterprise Officer | | | 2021 | | | | 337,500 | | | | 1,130,173 | | | | 1,223,361 | | | | 350,794 | | | | 315 | | | | 3,042,143 | |

(1) | The amounts shown in this column do not reflect the dollar amount actually received by the named executive officer, instead represent the aggregate grant-date fair value of awards granted to each named executive officer under our equity incentive plans, computed in accordance with ASC 718.

|

(2) | The amounts in this column represent the applicable named executive officer’s total annual performance-based cash bonus. See “Annual Cash Bonuses” for additional information regarding the bonus payments for the year ended December 31, 2021. For Ms. Belsky, the amounts in this column also include a sales commission bonus of $258,892, earned pursuant to our FY21 Enterprise Incentive Plan.

|

(3) | The amounts in this column represent the dollar value of life insurance premiums paid by us during the covered fiscal year for the benefit of the applicable named executive officer.

|

Narrative to Summary Compensation Table

We review compensation annually for all employees, including our named executive officers. In setting our named executive officers’ base salaries and bonuses and granting equity incentive awards, we consider compensation for comparable positions in the market, the historical compensation levels of our named executive officers, individual performance as compared to our expectations and objectives, our desire to motivate our named executive officers to achieve short- and long-term results that are in the best interests of our stockholders, and a long-term commitment to our company.

Base Salaries

In 2021, base salary was set at a level that was commensurate with each named executive officer’s respective duties and authorities, contributions, prior experience and sustained performance.

Annual Cash Bonuses

We maintain an Executive Incentive Compensation Plan in which our named executive officers participate. Participants are eligible to earn an annual cash incentive payment based upon an individual at-target incentive opportunity, which is assigned individually and expressed as either a target dollar amount or as a percentage of the named executive officer’s annual base salary earned during that portion of the year in which he or she is designated a participant in the plan. The actual incentive payment amount is determined based on the satisfaction of certain performance criteria and generally becomes payable, if at all, during the first quarter of the calendar year following the year the performance criteria are measured. Executives must be employed on the date of